Toute l'actualité des quatre coins du Bénin

Journée Mondiale de la Radio : La FeRCAB réaffirme le rôle clé des médias communautaires dans la paix et la sécurité

Atelier de validation étude énergétique

Atelier de validation étude Editoriale

Atelier de validation DIRO

Conférences sur le thème: "les réseaux sociaux pour promouvoir le contre discours et les messages positifs’’

NOS PROJETS

TechnoServe: Production des jeux radiophoniqu...

Care Bénin/Togo: Transfert monétaire

Projet d’Inclusion des Jeunes (ProDIJ) avec l...

Fondation Hirondelle

ÉCOUTEZ NOS RADIOS MEMBRES

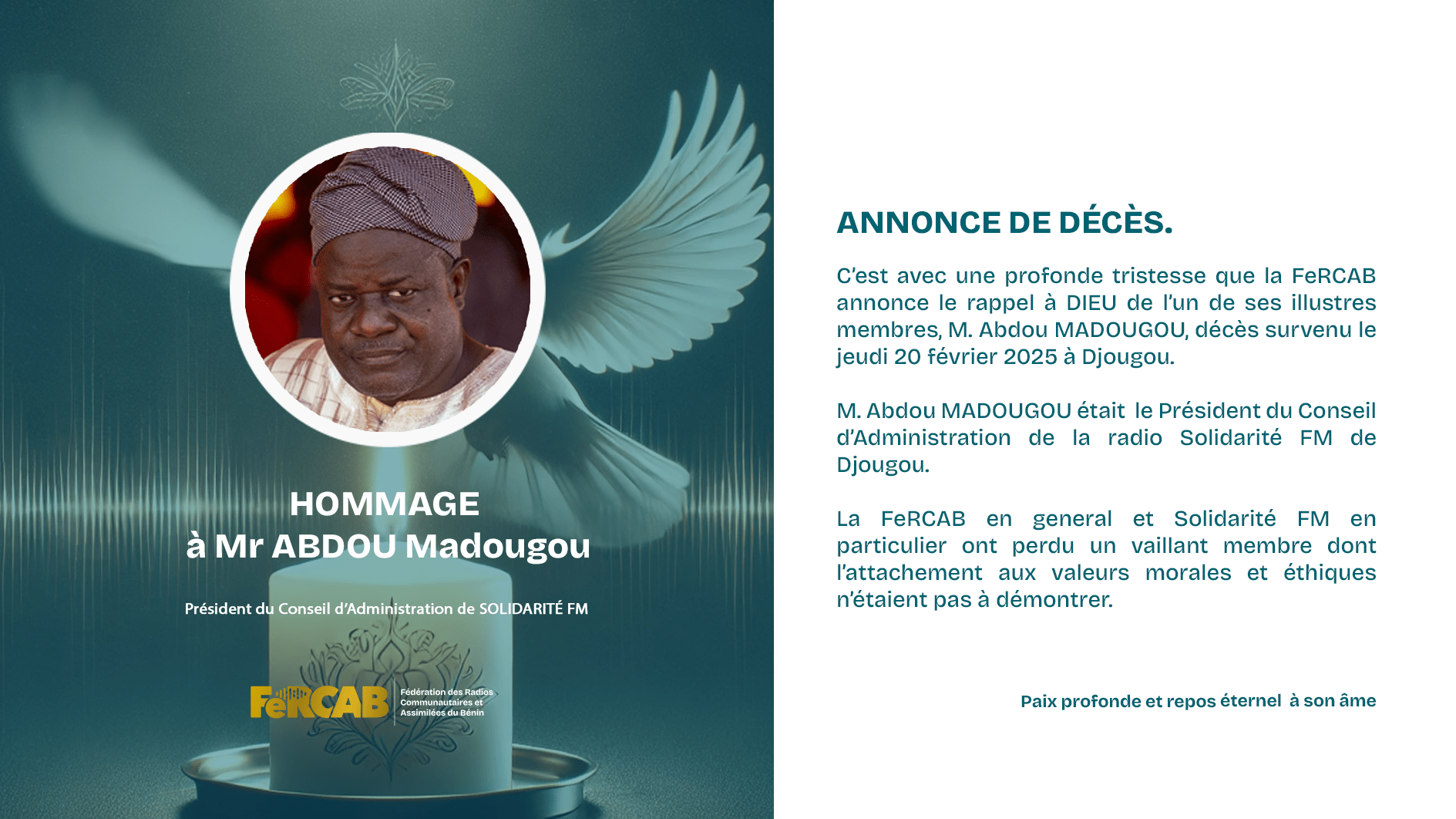

Solidarité FM

Djougou

97.0 MHz MHz

Écouter la radio

97.0 MHz MHz

Radio Ore Ofe

Tchetti

102.1 MHz MHz

Écouter la radio

102.1 MHz MHz

Moobo FM

Malanville

104.7 MHz MHz

Écouter la radio

104.7 MHz MHz

Radio Imonlè

Sakété

96.1 MHz MHz

Écouter la radio

96.1 MHz MHz

Radio Cite de Savalou

Savalou

87.8 MHz MHz

Écouter la radio

87.8 MHz MHz

FM Ahémé

Possotomè

87.7 MHz MHz

Écouter la radio

87.7 MHz MHz

Radio Naane

Péhunco

98.7 MHz MHz

Écouter la radio

98.7 MHz MHz

Radio Koné FM

Sinendé

103.8 MHz MHz

Écouter la radio

103.8 MHz MHz

Radio Saka Yérima

Pèrèrè

100.1 MHz MHz

Écouter la radio

100.1 MHz MHz

RRL Tanguieta

Tanguiéta

94.5 MHz MHz

Écouter la radio

94.5 MHz MHz

Radio Gbetin

Kpomassè

88.1 MHz MHz

Écouter la radio

88.1 MHz MHz

Alodaho Fm

Djidja

104.1 MHz MHz

Écouter la radio

104.1 MHz MHz

Radio Sedohoun Agbotagon

Allada

97.4 MHz MHz

Écouter la radio

97.4 MHz MHz

Radio Bio Guerra

Ségbana

104.0 MHz MHz

Écouter la radio

104.0 MHz MHz

Radio La Voix De La Lama

Allada

103.8 MHz MHz

Écouter la radio

103.8 MHz MHz

Radio Dinaba

Boukombé

99.6 MHz MHz

Écouter la radio

99.6 MHz MHz

Radio Ilema

Dassa-Zoumè

104.5 MHz MHz

Écouter la radio

104.5 MHz MHz

Radio Taneka FM

Copargo

93.5 MHz MHz

Écouter la radio

93.5 MHz MHz

Radio Entente FM

Toucountouna

89.4 MHz MHz

Écouter la radio

89.4 MHz MHz

Radio Kpasse

Ouidah

93.8 Mhz MHz

Écouter la radio

93.8 Mhz MHz

RRL Ouesse

Ouèssè

97.7 MHz MHz

Écouter la radio

97.7 MHz MHz

Radio Alleluia Fm

Porto Novo

96.5 MHz MHz

Écouter la radio

96.5 MHz MHz

Radio Maranatha

Parakou

103.1 MHz MHz

Écouter la radio

103.1 MHz MHz

Radio Kpably

Kérou

99.4 MHz MHz

Écouter la radio

99.4 MHz MHz

Radio IMATUNU KAKAI

Karimama

92.7 MHz MHz

Écouter la radio

92.7 MHz MHz

Radio Su Tii Sua

N’dali

103.5 MHz MHz

Écouter la radio

103.5 MHz MHz

Radio Cotonou

Cotonou

94.3 MHz MHz

Écouter la radio

94.3 MHz MHz

Radio Immaculee Conception D’allada

Allada

98.7 MHz MHz

Écouter la radio

98.7 MHz MHz

Radio Gerddes Akpro-Misserete

Akpro missérété

89.5 MHz MHz

Écouter la radio

89.5 MHz MHz

Radio La Voix Islamique De La Donga

Djougou

92.2 MHz MHz

Écouter la radio

92.2 MHz MHz

RRL Ouake

Ouaké

101.00 MHz MHz

Écouter la radio

101.00 MHz MHz

Tado FM

Abomey-Calavi

106.3 MHz MHz

Écouter la radio

106.3 MHz MHz

FM Kouffè

Bassila

103.0 MHz MHz

Écouter la radio

103.0 MHz MHz

Tuko Sari FM

Kouandé

105.8 MHz MHz

Écouter la radio

105.8 MHz MHz

Radio Olokiki

Pobè

105.3 MHz MHz

Écouter la radio

105.3 MHz MHz

Radio Su Tii Dera

Nikki

88.9 MHz MHz

Écouter la radio

88.9 MHz MHz

Radio GASU FM

Djakotomey

87.8 MHz MHz

Écouter la radio

87.8 MHz MHz

Radio APM

Porto Novo

89.0 MHz MHz

Écouter la radio

89.0 MHz MHz

Radio Nanto

Natitingou

96.3 MHz MHz

Écouter la radio

96.3 MHz MHz

Radio Mono La Voix De Lokossa

Lokossa

106.7 MHz MHz

Écouter la radio

106.7 MHz MHz

Kandi FM

Kandi

102.9 MHz MHz

Écouter la radio

102.9 MHz MHz

Radio Korédé

Gouka – Bantè

92.7 MHz MHz

Écouter la radio

92.7 MHz MHz

FM Alaketou

Kétou

95.8 MHz MHz

Écouter la radio

95.8 MHz MHz

Voix de la Vallée Adjohoun

Adjohoun

107.8 MHz MHz

Écouter la radio

107.8 MHz MHz

Radio Rurale Locale Lalo

Lalo

100 MHz MHz

Écouter la radio

100 MHz MHz

FM Nonsina

Bèmbèrèkè

90.8 MHz MHz

Écouter la radio

90.8 MHz MHz

Radio Gbassi FM

Kalalé

94.3 MHz MHz

Écouter la radio

94.3 MHz MHz

Radio Deeman

Parakou

90.2 MHz MHz

Écouter la radio

90.2 MHz MHz

Tchaourou FM

Tchaourou

104.7 MHz MHz

Écouter la radio

104.7 MHz MHz

RRL De Banikoara

Banikoara

104.2 MHz MHz

Écouter la radio

104.2 MHz MHz

Radio Idadu

Savè

107.8 MHz MHz

Écouter la radio

107.8 MHz MHz

Radio SOGEMA

Cotonou

87.5 MHz MHz

Écouter la radio

87.5 MHz MHz

Radio Benin Culture

Porto Novo

93.4 MHz MHz

Écouter la radio

93.4 MHz MHz

Radio Hosana

Porto Novo

90.6 MHz MHz

Écouter la radio

90.6 MHz MHz

Radio Tonignon

Zogbodomey

102.2 MHz MHz

Écouter la radio

102.2 MHz MHz

Amplifier les voix communautaires

La Fédération des Radios Communautaires et Assimilées du Bénin (FeRCAB) est le principal regroupement des radios de proximité du Bénin, engagé dans la défense et la promotion de l’information et de la communication au service des populations locales. Découvrez ci-dessous notre histoire, nos missions et nos moyens, qui témoignent de notre dynamisme et de notre impact sur le territoire béninois.

En savoir plus sur nous